With all the coverage in popular media outlets over the last few years, it would be hard not to have awareness of a claimed resurgence in the U.S. manufacturing industry. Beyond just a casual awareness, perhaps you also have been exposed to some of the most frequently cited factors driving this resurgence – or at least those that the press feels you might be interested in tuning in hearing about. As such, you might have come across discussions noting the positive impact of new energy production in North America on U.S. manufacturing. Or perhaps you have been exposed to information explaining that rising wage costs in competing counties such as China have pushed more manufacturing back to U.S. shores. No doubt, there is truth in many of the causal factors in circulation today regarding the improving U.S. manufacturing scene.

But is it true that recent improvements in the health and output of the U.S. manufacturing industry are solely due to factors extraneous to that industry itself? If so, how sustainable is this advertised resurgence? In all likelihood, if this trend truly is based only on extraneous factors that could just as quickly turn against U.S. manufacturing in the future, then the answer to this rhetorical question on sustainability has to be in the negative.

So this leads us to ask a follow-on question: Is there evidence of sustainable performance improvement from within the U.S. manufacturing industry itself that could also be contributing to its revived presence on the global stage? We are happy to say the answer to this question is most definitely in the affirmative. As an example, let’s review the latest findings on performance improvements within U.S. manufacturing from a recent study that was jointly conducted by MESA International (MESA) and LNS Research (LNS).

In an article published by LNS, an analysis of the most recent (2013) results from the “Metrics That Matter” survey by MESA was presented (MESA has conducted this annual survey since 2006 with a broad spectrum of manufacturers globally). This analysis endeavored to uncover findings in that survey that offered insight into what areas were contributing the most to performance improvements within the U.S. manufacturing community. From that analysis, eight high level areas of performance improvement were cited, each of these eight areas themselves being derived from a much larger subset of data tied to detailed metrics and key performance indicators that MESA investigated with its survey respondents. In no particular order of priority, here is a sampling from those eight key areas driving performance improvements from within the U.S. manufacturing industry itself:

- Financial Performance Improvement, 2012 to 2013 = 8.6%

This finding was distilled from survey responses on a variety of core metrics including Total Manufacturing Cost per Unit Excluding Materials, Manufacturing Cost as a Percentage of Revenue, Net Operating Profit, Productivity in Revenue per Employee, Average Unit Contribution Margin, Return on Assets/Return on Net Assets, Energy Cost per Unit, Cash-to-Cash Cycle Time, EBITDA, and Customer Fill Rate/On-Time Delivery/Perfect Order Percentage. - Innovation Performance Improvement, 2012 to 2013 = 7.8%

Derived from underlying findings such as Rate of New Product Introduction and Engineering Change Order Cycle Time. - Efficiency Performance Improvement, 2012 to 2013 = 17.0%

Top metrics from which this finding was derived included Throughput, Capacity Utilization, Overall Equipment Effectiveness (OEE), and Schedule or Production Attainment. - Responsiveness Performance Improvement, 2012 to 2013 = 10.0%

Detailed metrics from which this high-level factor was complied included On-Time Delivery to Commit, Manufacturing Cycle Time, and Time to Make Changeovers. - Quality Performance Improvement, 2012 to 2013 = 13.7%

Metrics used to generate this improvement factor included Production Yields, and Customer Rejects/Return Material Authorizations/Returns, Incoming Quality from Suppliers. - Inventory Performance Improvement, 2012 to 2013 = 15.0%

This finding was based on changes in inventory turnover ratios for WIP. - Maintenance Performance Improvement, 2012 to 2013 = 14.7%

This finding was distilled from detailed metrics including Percentage Planned vs. Emergency Maintenance Work Orders and Downtime in Proportion to Operating Time. - Compliance Performance Improvement, 2012 to 2013 = 14.7%

Derived from underlying metrics including Reportable Health and Safety Incidents, Reportable Environmental Incidents, and Number of Non-Compliance Events per Year.

As can be discerned from the findings highlighted above, manufacturers in the U.S. have been working hard to improve their competitiveness on the global stage. Certainly overseas competitors have been making improvements as well, but improvements of this magnitude are not easily obtained, especially when using prior year performance in a mature marketplace such as the U.S. manufacturing sector as a basis for comparison. Sustaining future year-over-year improvements such as this within the U.S. manufacturing sector will go a long way in driving the rebirth of this U.S. industry, regardless of which direction the winds of extraneous good fortune happen to be blowing.

For many years now, manufacturers around the world have pursued and embraced the philosophies and methods of Lean Manufacturing (Lean) to improve their business. To summarize, some of the common benefits attributed to the successful use of Lean methods are:

For many years now, manufacturers around the world have pursued and embraced the philosophies and methods of Lean Manufacturing (Lean) to improve their business. To summarize, some of the common benefits attributed to the successful use of Lean methods are:

- Improved inventory turnover ratios

- Improved product quality and reduced scrap rates

- Higher labor productivity ratios

- Improved revenue to cost of labor ratios

- Improved employee morale

- Better overall customer service from a given level of investment in assets such as facilities and materials

- Improved competitive position against non-Lean rivals

The same can be said for Just-In-Time (JIT) style production systems. Some of the common benefits attributed to JIT are:

- Improved inventory turnover ratios

- Reduced inventory holding costs

- Reduced costs from obsolete and slow moving inventories

- Improved product quality and reduced scrap rates

- Reduced levels of working capital required to support a given level of production output

- Improved flexibility and agility in manufacturing operations

- Improved new product introduction to manufacturing cycle times

- Improved employee morale

- Improved competitive position against non-JIT rivals

As can be seen from the simplified set of benefits attributed to JIT and Lean above, there are a number of similarities in expected outcomes. This should not be surprising as key roots for Lean Manufacturing can be found in JIT. In fact, the two are similar enough that some consider them to be two names for the same thing. This, however, is not the case. In its heyday, JIT was primarily focused on the efficiency of production and the inventories and supply chains that supported it. Lean absorbed that core focus and then expanded on it to address the broader customer value cycle of an entire manufacturing business.

Looking a little deeper into a comparison of Lean and JIT, another key commonality can be found between the two – the concept of velocity. In fact, many of the benefits attributed to both Lean and JIT are in fact related to improvements that these systems provide in terms of velocity. However, velocity is not a goal of these systems that can be achieved in a vacuum. The laws of physics such as cause and effect are also operative in the world of manufacturing methodologies.

In the past, achievement of optimal velocity in these systems has required as predicates two other conditions to be met first: 1) demand and supply stability, a feature of a level-loaded production environment, and 2) demand and supply synchronization, outputs of the system being pulled upon by demand must be in balance with inputs to that system such as inbound material flows and labor/machine capacities.

While achieving these predicates has been reproduced successfully within a number of different manufacturing operations over the years, that success rate has dropped significantly when pushed out beyond the four walls of a manufacturing operation into the supply chain that supports it. As with many other systems, Lean and JIT can only be as strong as the weakest link in the chain. Even the application of advanced information technologies available in modern ERP, SCM, and PLM systems has failed to overcome the limitations of fully stabilizing and synchronizing the external supply chains of successful Lean and JIT practitioners.

However, this shortcoming in extended Lean and JIT manufacturing systems may finally be nearing a point where external supply chains can achieve the performance levels necessary for nearing a state of optimal performance within these methodologies. This enabler for the next evolutionary stage in Lean and JIT systems is the Industrial Internet.

To help in envisioning how the Industrial Internet could be applied to improving on Lean and JIT based systems, consider the example below as a simplified flow of information in a company using these manufacturing approaches today:

Even in a pull based production flow such as depicted above, success is dependent on several expectations tied to stability and synchronization. Examples of this would include:

- There is a known and highly repeatable cycle time inherent in this flow.

- Finished goods supermarket sizing (predicated on expected rates of demand and cycle time to replenish) is appropriate to actual sales fulfillment needs.

- There is very little disruption in the flow from things such as equipment breakdowns, quality issues, or external factors such as severe weather events.

Unfortunately, in the real world these expectations are not actually incontrovertible facts. In today’s environment, when the real world fails to live up to the expectations that a synchronized one piece flow in Lean / JIT manufacturing process depends upon, Lean/JIT systems encounter disruptions that can impact on both customers and the bottom line of the company.

In a future in which the Industrial Internet is fully deployed and operational, disruptions will still occur, but the ability of the overall system to sense (or even predict) and adapt to these anomalous occurrences will be dramatically improved. A few examples of how this hypothesis could play out include:

- Predictive analytics tied to real-time consumer demand patterns could be used to adjust supermarket and downstream kanban sizing before actual demand consumes goods from the supermarket.

- Real time production equipment monitoring and failure condition analysis will greatly reduce the potential for unplanned breakdowns.

- Machine-to-Machine (M2M) communications could signal replenishment requirements in real time, long before a manual kanban card system would.

- These same concepts could be applied to interactions with vendors, achieving the long sought for benefits of a truly interconnected supply chain.

All of these changes will exert significant positive benefits on the magnitude and velocity of information being generated / shared across shop floors as well as throughout global supply chains. In turn, this age of high velocity interconnected data streams will bring even greater velocity to the material and product flows supporting manufacturing operations of the future.

In such an envisioned future state for Lean/JIT based manufacturing operations, the main risk to the integrity and operability of the system may become the internet itself, as well as the information technologies that would interconnect and harmonize all the moving parts of such a system via the internet.

While we are just beginning to explore the possibilities of the Industrial Internet, part of that exploration needs to include rethinking how our manufacturing operations, and other supporting applications such as ERP, MES, SCM, and networking systems, need to change to be ready for this brave new world.

Originally submitted at Eastern Mountain Sports

Serious light in a fun, cool design—the Nite Ize BugLit Micro Flashlight may be the most innovative and versatile hands-free flashlight you'll ever use.

Flexible, Useful, and Fun

Pros: Bright, Reasonable Price, Multiple uses

Best Uses: Bedside, Camping/Hunting, In The Car, Gifts, Outdoors, Emergencies

Describe Yourself: Avid Do-It-Yourselfer

Primary use: Personal

This is one of the most creative and useful form factors for a general purpose pocket/pack light I have ever seen.

(legalese)

Overall, the economic impact of manufacturing on U.S. GDP has been trending lower for many years. Services related sectors of the economy have continued to grow in importance as manufacturing has contacted (these figures can be misleading, however, since US manufacturing has become a huge consumer of services).

That is today, but what is the future of manufacturing in the U.S.?

Technologies of the future will revolutionize the manufacturing industry, providing an opportunity to reenergize this former wealth building engine of the nation. While many new technologies are surfacing, it seems likely that a convergence of those noted below in creating Factories of the Future hold the most promise for driving this renaissance:

Advanced Sensors – Future sensors will be intelligent, capable of interacting with other sensors in real-time to form a better understanding of an activity or environment.

Robotics – The flexibility, mobility, and ease of programmability present in today’s industrial robots have opened many new applications for this technology.

Additive Manufacturing – Additive manufacturing is a great fit for engineering driven, custom build based processes used by equipment builders.

Industrial Internet – Forming the central communications and neural network of the globally integrated Factory of the Future, this derivative of the Internet of Things (IoT) will be the enabling backbone that brings these various new technologies together as a synergistic whole.

We are on the doorstep of the Fourth Industrial Revolution – also being called “Industry 4.0.”

- Industry 4.0 will include “cyber-physical production systems” interacting with sensor-laden “smart products” that will tell production machines and systems how they should be processed.

- Rigid, centralized factory control systems will give way to decentralized intelligence and flexibility as machine-to-machine (M2M) communication optimizes the shop floor autonomically.

- Manufacturing processes will govern themselves in a decentralized, modular system.

- Smart devices will work together via the Industrial Internet to create an industrial cloud of digital data (a subset of “Big Data“) which spans the globe, creating an entirely new construct for supply chain management.

As with all past revolutions, some with the foresight and ingenuity to move forward into the new paradigm will prosper. Many who do not adapt will be left in dusty recollections of a time gone by. What will the future of your organization be – successful pioneer or a fading memory?

It’s that time of year again. Another session of Congress, another bill authorizing the creation of a National Manufacturing Strategy in the U.S. This year’s flavor is H.R. 2447, “The American Manufacturing Competitiveness Act of 2013”, introduced by U.S. Rep. Dan Lipinski (D-IL-) on June 20, 2013. As of this writing, the bill remains in subcommittee in the House. Just like its most recent predecessors, “The American Manufacturing Competitiveness Act of 2012” (HR-5865), and “The National Manufacturing Strategy Act of 2011,” (HR-1366), it is given little chance of actually being enacted into law. In fact, manufacturing in the U.S. has become an interesting topic for our Congressional leaders of late. At present, there are at least eight different bills before Congress dealing with various aspects of returning the U.S. to a more competitive position in this global industry. Other entries in this category that are under consideration by Congress this year include:

• “Make It In America Manufacturing Act of 2013” (H.R. 375)

• “Clean Energy Technology Manufacturing and Export Assistance Act of 2013” (H.R. 400)

• “Market Based Manufacturing Incentives Act of 2013” (H.R. 615)

• “Scaling Up Manufacturing Act of 2013” (H.R. 616)

• “Rebuild American Manufacturing Act of 2013” (H.R. 1127; S. 544)

• “Partnering with American Manufacturers for Efficiency and Competitiveness Act” (H.R. 1418)

• “Advancing Innovative Manufacturing Act of 2013” (H.R. 1418)

• “Manufacturing Economic Recovery Act of 2013” (H.R. 1522; S. 63)

The real question is, does our political leadership actually intend to take action to reinforce the competitiveness and viability of American manufacturing or is this flurry of bill writing further examples of our politicos pandering to the populace on hot topics of the moment?

In actuality, the debate over a national manufacturing strategy in the U.S. has been with us for many years now. The intensity and public visibility of this debate ebbs and flows like the tide. “The American Manufacturing Competitiveness Act of 2013”, is one more installment in a book of many chapters. At the heart of the case made by current proponents of this bill are many of the same issues voiced by others from the past in this now perennial exercise in American economic and political discourse. Chief among these is the observation that many, if not most, of the developed nations that U.S. manufacturing competes with on the world stage already have national strategies of their own in place. Citation of this fact in the debate dates back at least to the late 1980’s when the Japanese manufacturing empire was inflicting heavy casualties on their U.S. and other global competitors. Current proponents cite the same nation-state led strategic approach to manufacturing strategy when discussing 21st century competition with China.

There is no doubt that a well-coordinated and well-funded national program to advance any given country’s selected business pursuits has a competitive impact. This has been proven over and over again throughout history. However, it is also a concept that challenges the very foundations of a capitalistic free enterprise system as it implies that the state takes a direct and decisive role in determining winners and losers in the marketplace. That has been a key rallying point for critics of a national manufacturing strategy in the U.S. for many years. However, as the U.S. is unlikely to alter the given that other nations are proactively pursuing national manufacturing strategies to the benefit of their own self-interests, is it finally time to set our altruism aside and assume this same approach?

Perhaps not. There may be another way. The key to unlocking a national manufacturing strategy that is both economically meaningful and politically acceptable may already be at hand. The first part of this key can be found in the pioneering initiatives being taken by the Obama administration under the National Network for Manufacturing Innovation (NNMI). By sponsoring these public/private collaboratives to advance cutting-edge technologies that will positively impact on the future competitiveness of U.S. manufacturing, the White House has both reinvigorated national policy and focus on manufacturing as well as set in motion much needed research and development that was too costly or risky for any one actor in the private sector to undertake alone. To summarize, this is an example of the Innovation Engine for this new approach to a national manufacturing strategy.

The second part can be found in the pioneering research by various groups including the team at the Massachusetts Institute of Technology and their groundbreaking Production in the Innovation Economy (PIE) report. As part of the work performed by this research team it was found that success in competitive 21st century global manufacturing was dependent on the existence of complimentary manufacturing networks from which the participants in these networks could derive much needed benefits in the areas of coordination, risk-pooling / risk-reduction, and bridging. These networks provide the support and collaboration required for a manufacturing ecosystem driven by innovation. Convening these networks in the U.S. at present is an ad hoc process, sometimes sponsored by a public body and in other cases sponsored by either a private or academic organization. The U.S. needs to learn what works in these collaborative networks and then sponsor and support them it in a more systematic way. To summarize, this would be the fabric for the Enabling Network supporting a U.S. manufacturing strategy.

The third part would be a concerted effort to alter the current course of public policies and programs toward a scenario that would encourage and support success for American manufacturers. For too long, this former powerhouse of the U.S. economy has been neglected by our governmental and political leadership. That must change if there is to be any real benefits realized from a national manufacturing strategy. Among numerous changes that must manifested here to give U.S. manufacturers a fighting chance on the global landscape, primary focus must be paid to:

• Taxation – revamp current taxation policies that impede growth, constrain capital formation, and incent exportation of jobs and profits.

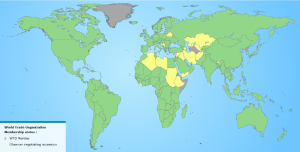

• Trade – remove competitive trade barriers and aggressively challenge unfair trade practices and intellectual piracy.

• Workforce – pursue meaningful reorganization of our educational systems and institutions to provide our citizens with the knowledge and skills required for success in 21st century manufacturing jobs at a reasonable cost to both students and the public at large.

• Infrastructure – renew our roads, bridges, rails, airports, pipelines, water systems, and energy storage facilities as well as digital infrastructure such as smart electric grids, intelligent transportation systems, and fixed and mobile broadband communications networks to support the ability of manufacturers to successfully conduct commerce in the U.S. on a playing field equal to or better than our global competitors.

This would be the Supporting Infrastructure element of a new national manufacturing strategy in the U.S.

Taken as a whole, the convergence of these three elements into a new approach to a National Manufacturing Strategy in the U.S. would become an enabler to a renaissance of this critical industry on the American landscape without trampling our national beliefs or philosophies in the process.

“Change is hard. Have you ever tried to bend a coin?”

It’s not just technology that’s moving faster than ever these days. Everywhere you look, change is rapidly transforming the world, and businesses need to take these radical shifts into account.

Drawing upon the work of Clayton Christensen and sprinkling in citations from a number of forward thinkers such as Ray Kurzweil, Peter Drucker and Saul Kaplan, an article on the Innovation Excellence website summarizes a powerful lens into the future business world we are rapidly accelerating toward.

As the author of “The Innovator’s Dilemma” in 1997, Christensen provided insight into the nature of disruptive technologies in the business world and why corporations efficiently manage their way into failure as they grow away from embracing “empowering innovations” in favor of the faster return on investment provided by “sustaining innovations” or less risk prone “efficiency innovations.”

To paraphrase: in a global environment increasingly driven by change, outdated managerial wisdoms teach business leaders to leave themselves exposed to disruptors. These fast and agile disruptor companies are willing to take risks on empowering innovations that seemingly entrenched corporate behemoths have chosen to ignore. Once those empowering technologies find a foothold, the smaller firm quickly expands and displaces the slow-to-adapt business bureaucracy of the larger firm.

Adding to the insights cited from Kurzweil’s publications, further contributions are drawn from the works of Kaplan that discuss adapting business models to embrace the flexibility required in a rapidly changing environment. With that as a base, the author then adds the thinking of Drucker about modes of management that are better suited to a knowledge economy in which change occurs at digital rather than analog rates.

Blending these varied views of businesses, economies and societies struggling to adapt to the rate of change that our technologies are imposing on us, the Innovation Excellence article posits four themes that define this shift.

- Business people today still think in linear terms about cause and effect, but technology is transforming so rapidly that linearity is being replaced by unpredictable random leaps.

- Changes across the spectrum, from the nature and availability of business financing to the emergence of cloud computing, have eliminated moats that large businesses previously could use to defend themselves against smaller but faster upstarts.

- Business models forged on a single strategy that could endure for a lifetime have been replaced by a strategy to have no fixed single strategy. Rather, business models today must exist in multiple modes that can easily be rotated into use as the factors in the environment dictate. Better still, they should not be models at all in the conventional sense — abandoning past thinking about strategy and planning in favor of adaptive collaborations between self-empowered actors sharing a common insight into a perceived future possibility and the freedom to adapt as that future possibility becomes more or less probable.

- Management that embraces change and empowers the ability to adapt and innovate, mentoring and guiding an organization rather than directing and controlling it.